Simple payback period formula

The result of the payback period formula will match how often the cash flows are received. Investment Annual Net Cash Flow From Asset.

Discounted Payback Method Definition Explanation Example Advantages Disadvantages Accounting For Management

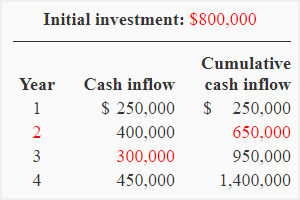

It can get a bit tricky when annual net cash flow is expected to vary from year to.

. Payback period in capital budgeting refers to the time required to recoup the funds expended in an investment or to reach the break-even point. The payback period is the total investment required to purchase the asset or fund the project divided by the net annual cash flow which is gross cash flow minus expenses. The simple payback period formula would be 5 years the initial investment divided by the cash flow each period.

Payback Period Initial Investment Annual Payback For example imagine a company invests 200000 in new. Cumulative Cash flows for last period. Management uses the payback period calculation to decide what investments or projects to pursue.

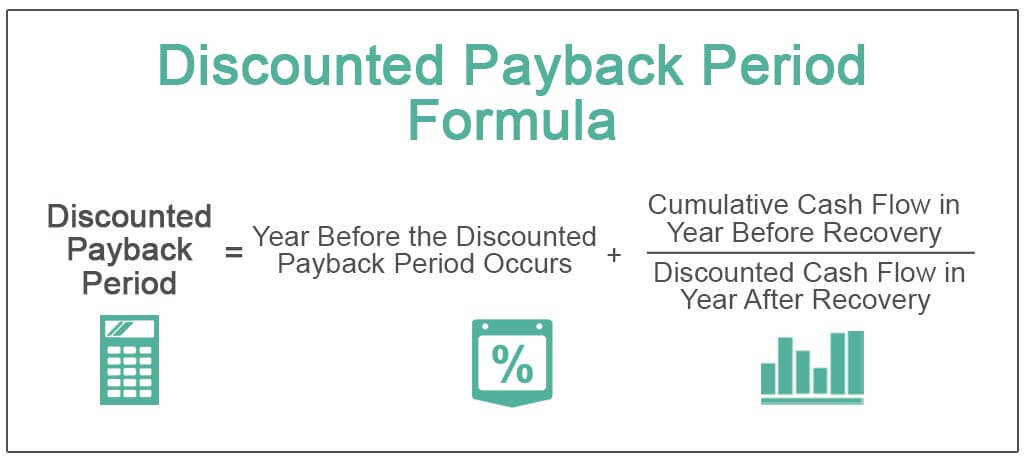

Discounted Cash flows for Last period 8196. The payback period is expressed in years and fractions of years. Discounted Payback Period Formula Discounted Payback Period Year Before the Discounted Payback Period Occurs Cumulative Cash Flow in Year Before Recovery Discounted Cash.

100 20 5 years Discounted. For example a 1000 investment made at the. The point of no profit and no loss is the break-even point.

To find exactly whats the discounted payback period is we do the following simple math. Hence the total pay-back period will be. However the discounted payback period would look at each of those 1000.

The payback period calculation is simple. For example if a company invests 300000 in a new production line and the production line then produces. We obtain the break-even point of a project when the net cash flows exceed the initial.

Payback Period Amount to be InvestedEstimated. 68 ie the time taken to generate this amount will be 022 years 68308. Formula The simple payback period formula is calculated by dividing the cost of the.

The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows. Now the time taken to recover the balance amount of Rs. Written out as a formula the payback period calculation could also look like this.

Payback Period Initial investment Cash flow per year As an example to calculate the payback period of a 100 investment with an annual payback of 20. An example would be an initial outflow of 5000 with 1000 cash inflows per month.

How To Calculate The Payback Period With Excel

What Is Payback Period Formula Calculation Example

Payback Period Business Tutor2u

Calculation Of Pay Back Period Pbp Assignment Point

How To Calculate The Payback Period With Excel

What Is Payback Period Formula Calculation Example

Payback Period Business Tutor2u

Energy Management And Planning Msj 0210 Measures For

Summary Of Payback Period Abstract

Discounted Payback Period Meaning Formula How To Calculate

Payback Period Formula And Calculator Excel Template

Payback Period Formula And Calculator Excel Template

Payback Period Method Commercestudyguide

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

Payback Period Formula And Calculator Excel Template

How To Calculate The Payback Period With Excel

Discounted Payback Period Definition Formula Example Calculator Project Management Info